Estate and Gift Planning Consulting

Inheritance and gift planning is essential. Not only does it allow for tax-saving opportunities, but it is also an important life plan that ensures you can pass down your hard-earned assets to your loved ones according to your wishes. Tmax Group supports this planning and execution, helping you minimize taxes.

Gift

Gift refers to the act and agreement of transferring assets to someone, accompanied by a declaration of intent to grant those assets.

Inheritance

Inheritance means that, upon the passing of the decedent, all their rights and obligations transfer to their heirs. In cases where a will is present, the instructions in the will take precedence over the standard legal methods of inheritance.

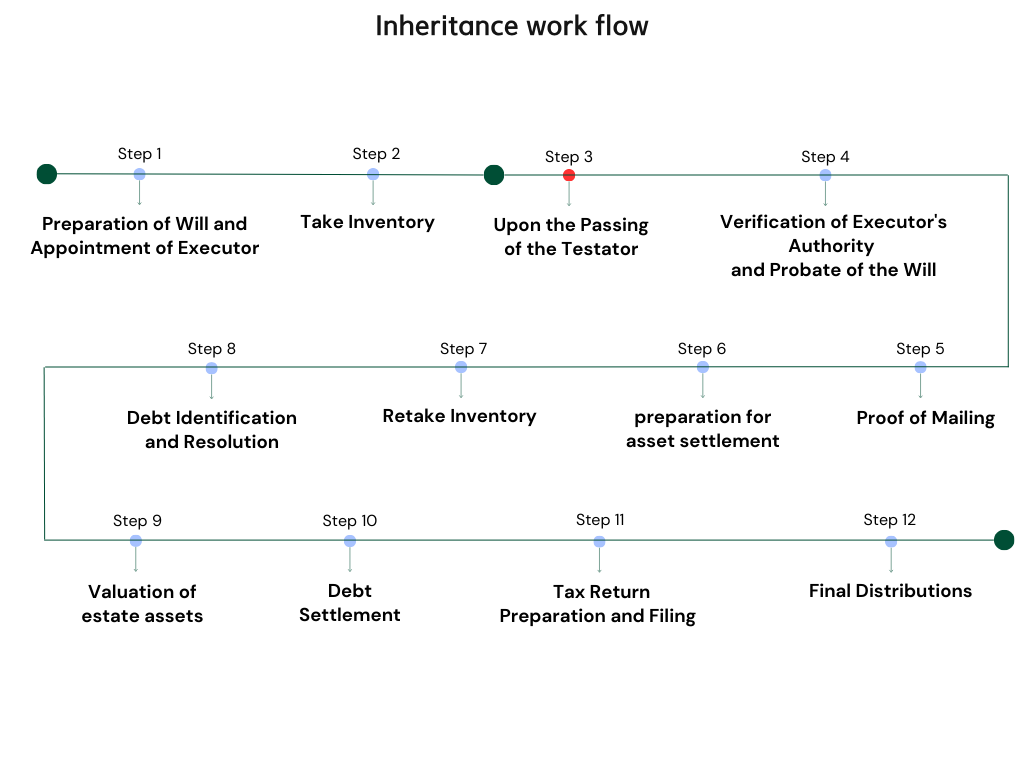

Inheritance Services

- Executor: The executor is responsible for distributing assets according to the decedent’s will and overseeing legal procedures.

- Will Preparation

- Asset List Compilation

- Issuance of Estate Tax ID and Opening of Escrow Account

- Probate (Will Validation)

- Final Income Tax Reporting

- Distribution to Heirs

- Inheritance Tax Filing: Filing of federal inheritance tax via Form 706, to be filed by the estate executor.

Gift Services

- Gift Tax Filing: Form 709 is used to report gifts exceeding the annual exclusion amount.

- Form 3520: This informational report is required when receiving a gift from a non-resident.