Tax Consulting

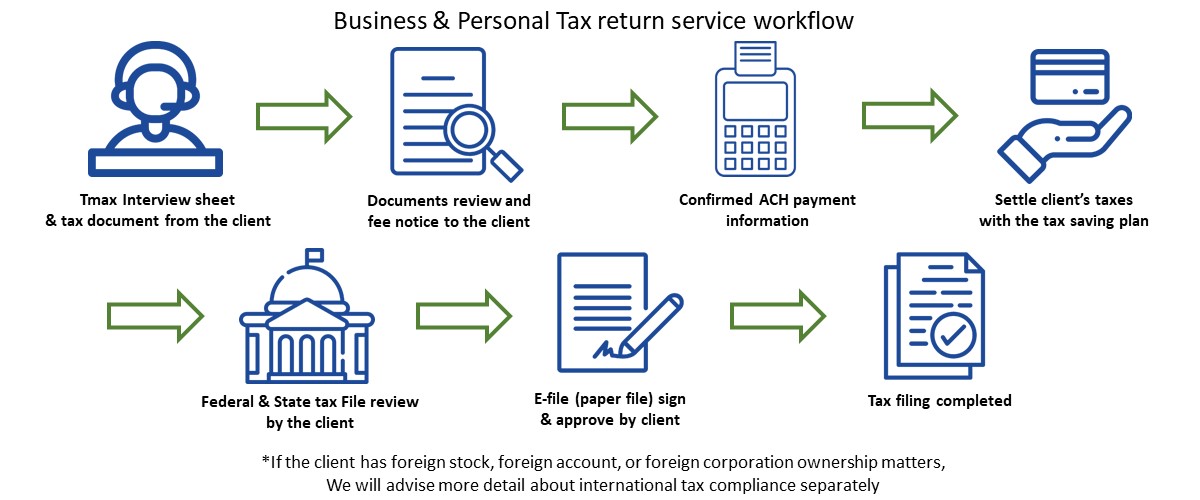

Tmax tax experts take a historical approach to tax preparation and provide specialized tax planning, international tax and tax treaty based on the situations of each customer. Our main expertise is a very effective tax saving plan for our customers. Tmax tax consulting services focus on identifying federal, state and local programs that support and benefit businesses and individuals.

Tmax Group also provides personal tax related consulting services for all 50 states.

Service includes but not limited to:

- Personal / Business Income Tax Resident / Non resident personal income tax file and payment and business income tax preparation and payment

- ITIN application as a Certifying Acceptance Agent Individual tax identification number application services as a Certifying Acceptance Agent

- Gift/Estate/Inheritance tax file and advisory Any advice for gift, estate, inheritance tax file and consulting

- FBAR/FACTA filing Foreign financial accounts file and advisory based on FBAR/FATCA filing requirement

- Filing for Foreign corporation shareholder and invenstment IRS Filing for foreign corporation from US resident or domestic entity

- Streamlined filing procedures Tax and foreign financial accounts file and payment through streamlined filing procedures without or lower penalty.

- IRS penalty and interest adjustment or installment set up IRS penalty or interest adjustment or payment installment set up by representing tax payers under IRS regulation.

- Personal tax audit and files consulting Any IRS personal tax audit represent and filing consulting

- International tax law and tax treaty experts International tax law and tax treaty consulting for personal and business

- To relinquishment of US Citizen or permanent resident.(Exit Tax) The IRS announced procedures for certain persons who have relinquished, or intend to relinquish, their US citizenship or their green card who wish to come into compliance with their U.S. income tax and reporting obligations.